A consistent cash flow is essential to the expansion and growth of all freight companies. However, things may get complicated when a freight company allows customers to wait weeks or months before making a payment. When something like this happens, freight firms often have very few resources.

Ultimately, companies will not deliver timely, growth will be stagnant, and if they don’t pay their drivers, they may even lose valuable, experienced drivers. A company’s operations might be severely impacted, and its prospects of surviving in a brutal and highly competitive market may be reduced due to late customer payments. To solve this, some freight businesses choose to use truck factoring.

Table of contents

- What is Truck Factoring?

- What is the Difference Between Recourse and Non-Recourse Factoring?

- How Does Truck Factoring Work?

- What Does a Truck Factoring Company Do?

- How Do You Qualify for Factoring?

- Truck Factoring Process

- Should I Choose Truck Factoring for my Trucking Company?

- How to Choose a Freight Factoring Company?

- Truck Factoring Application Process

- What to Check in Contract Terms?

- Pros and Cons of Truck Factoring

- Bank Loan VS Truck Factoring

- How Much Does Truck Factoring Companies Charge?

- Do I Need a Factoring Company To Be Successful As An Owner-Operator?

- Final Words

What is Truck Factoring?

Instead of waiting 30, 60, or even 90 days for a load to be paid out, freight factoring, sometimes referred to as trucker factoring, takes the invoices for the loads you run and ensures you get paid on them immediately. This allows working capital to come in and keep the company running between invoice payouts.

Since invoice payments are rarely issued immediately, the transportation industry standard is for reimbursements to drivers and trucking businesses to take 40 days or longer to process; this becomes an essential business tool for the trucking industry. A freight company’s budget may be made or broken by these processing timeframes, and many have occasionally had to look for other sources of income.

When there are more “payouts” than “pay-ins” on the balance sheet, many people used to rely on bank loans or even credit cards to make ends meet. This isn’t easy to manage and may result in thousands of dollars in interest payments, particularly for the trucking firms over time.

When a business or owner-operator uses freight factoring for truckers, they deliver their goods as usual, but rather than waiting for Payment, they “sell” or transfer the job’s invoice to a different business. This business will “buy” the invoice for a little less than the amount due for the work, but they will make up the difference by making the Payment immediately.

A business owner sells unpaid bills to a factoring company at a discount. This process, known as factoring, is often called invoice or accounts receivable factoring. A portion of the invoice amount is paid to the business owner in advance by the factoring company, which also assumes responsibility for collecting Payment from the company’s clients. Business owners can obtain funding through factoring without applying for a small business loan.

The procedure entails some fees, but the specifics vary depending on the factoring business. Before entering an invoice factoring contract, trucking businesses should know the price structure, as some companies impose application fees for registration and collection fees. However, trucking businesses would have to pay the factoring lender a small percentage of the total invoice amount.

Read Also: – Proven Sales Closing Techniques And Strategies

What is the Difference Between Recourse and Non-Recourse Factoring?

They are the two invoice factoring types. They vary in aspects, such as average costs, qualifying standards, and who is responsible for nonpayment.

Recourse Factoring

The most prevalent kind of invoice factoring is recourse factoring. If your clients default on their payments, you will eventually be liable for the debt under a recourse factoring arrangement.

Every attempt should be made by the factoring business to collect the repayment on your behalf. If it fails, though, it may demand compensation from you. In this situation, you must purchase the invoice from the factoring lender, which means you must pay back the money now owed and try to recover the debt from clients.

If you cannot get Payment from your clients, you must accept the loss. Consequently, you, the borrower, take on a greater risk related to potential nonpayment via recourse factoring.

Non-Recourse Factoring

In contrast, non-recourse factoring entails that the factoring provider takes on most of the risk associated with your clients’ nonpayment. If your clients don’t repay, the factoring business takes that loss and manages all efforts to recover their money under a non-recourse factoring agreement.

Certain non-recourse factoring agreements, however, are limited to particular circumstances. If your consumer fails to make payments in this instance, you can still be liable for the debt. A factoring company can, for instance, restrict non-recourse to client companies that have shut down or filed for bankruptcy, making you, the borrower, accountable for any unpaid debt.

Recourse and Non-Recourse Factoring

Recourse factoring is more frequent than non-recourse factoring because recourse factoring is less risky for the factoring business. If a business does provide non-recourse factoring, you will usually have to demonstrate to potential clients that your clients have solid credit histories and a track record of on-time payments.

Therefore, which party is eventually held accountable for client nonpayment is the main difference between recourse and non-recourse factoring.

Recourse factoring places accountability on the company. Meanwhile, the factoring lender bears responsibility for non-recourse factoring. That said, the terms of the arrangement may dictate some restrictions.

| Comparison | Recourse | Non-Recourse |

| Advance Rate | Higher (more upfront funding). | Lower |

| Factoring Fees | Lower | Higher |

| Speed | Faster | Slower. Factoring companies may ask for additional requirements for application or a thorough process of approval for invoices. |

| Qualification | Easier. Factoring companies look at the payment history and credit score of your clients. They are often flexible in terms of requirements. | Harder. Factoring companies might ask for timely payment and strong credit history records from your clients. |

How Does Truck Factoring Work?

Getting paid swiftly could prove crucial to success in the trucking profession. Through factoring, you can send invoices to your factoring business for same-day processing and receive Payment for the invoice amount way sooner, rather than after weeks. This provides you with the funding you require to sustain your company’s growth. Freight factoring functions because there is a motive for each party involved, just as in any other economic transaction.

Instead of waiting long, the freight business or owner-operator receives instant money. The percentage that the truck factoring company charges, or “leaves out,” of the invoice when they buy from the driver serves as an incentive. This profit is realized when the company collects the invoice from the client. Finally, dealing with a corporation with the financial resources to wait for reimbursement rather than a little freight company practically starving to death offers the consumer an incentive.

Read Also: Black Owned Banks

What Does a Truck Factoring Company Do?

Understanding the fundamental services truckers receive from factoring companies and the special services that make them stand out from the competition is critical. Both are present in TAFS! In as little as an hour, our top-notch factoring services can buy your bills and get you paid in full. TAFS offers its clients premium services in addition to factoring, which will help you stay ahead of the competitors in the field.

Let’s Examine the Invoice Factoring Procedure in More Detail

- A business (client) requires shipping from A to B.

- Once you are hired to deliver it, you check your factoring company’s credit report to determine if the customer’s load qualifies for their services.

- If so, you give your factoring business the invoice and all load-related documentation upon delivery. (Paperwork is typically filed online or via a mobile application, such as the rate cone, bill of lading, etc.)

- They buy that invoice and send money to you or your business.

- The factoring business subsequently collects the customer’s money.

This procedure could have a few more phases, depending on various circumstances. It’s better to consider applying for factoring as if it were the same as applying for a credit card or health insurance for the sake of this article. This is because businesses and owner-operators apply to factoring companies rather than merely hiring them. Furthermore, the conditions of the factoring agreement will ultimately depend on the form of this application.

To give you an example, let’s say that trucking businesses frequently seek invoice factoring for payroll-related reasons. In addition to paying for petrol and car upkeep, a trucking firm must pay its fleet’s salaries. However, funds may not always cover all of these costs. Without quick access to funding, the company can have financial difficulties.

Trucking companies must ensure they have the funds to sustain their business using invoice factoring. Let’s take an example where a trucking firm needs funds for payroll as soon as possible. They have $100k in overdue bills. They use FundThrough to request finance, and within a few days, they get $97,250 at a reduced rate of 2.75% for 30 days.

They may collect the money immediately by factoring in their bills, enabling them to continue operating their drivers. In this sense, invoice factoring facilitates trucker business maintenance and improves cash flow management.

Remember that factoring companies could impose an additional fee, lowering the total profit on a load. Nevertheless, truckers often accept this compromise to guarantee a steady stream of revenue and maintain the efficient functioning of their businesses.

How Do You Qualify for Factoring?

While qualification scenarios vary across factoring, the following are some common ones:

- You invoice other companies while conducting business as a B2B entity.

- An operating permit and a business license that is current

- A minimum revenue requirement of $1000 every month

- Reputable clients

- You live in a nation where the factoring company conducts business.

- No liens (though liens are frequently still an obstacle for many businesses).

- No uncontrolled tax balance—Regularly arrange payment schedules for businesses with the IRS and CRA.

- A fully operational business bank account records the bills being factored in.

The following are some of the documents you should present:

- Documents of establishment and LLC certificates are examples of business creation paperwork.

- Government-issued identification: A passport or a driver’s license is an example.

- Tax Identification: You must give the factoring company permission to look up your company’s tax history.

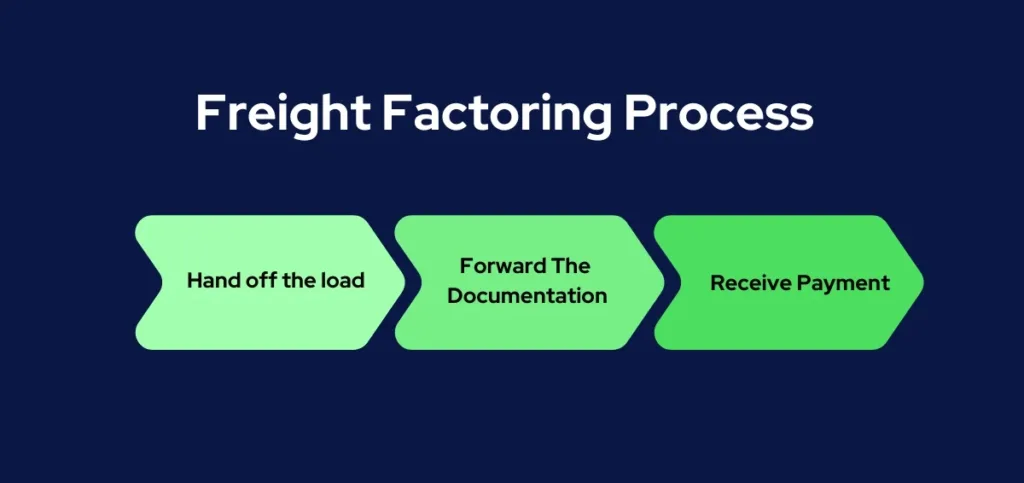

Truck Factoring Process

1. Hand off the load

After you deliver the freight and get your documentation signed, you pick it up.

2. Forward The Documentation

Send the bill of lading, rate confirmation, and invoice to the factor that attests to the delivery of the consignment. The factor knows there are no freight disputes or other problems impeding Payment.

3. Receive Payment

By buying your invoice, Factors advances you up to 98% of the invoice’s value in less than a day. Usually, a direct transfer is made into your bank account. Alternatively, you have the option to charge it to your gas card.

A few top factoring companies provide a mobile app and web interface. Before leaving the port, you may quickly turn in your paperwork from the comfort of your truck using a laptop, tablet, or smartphone. You know that you will have money in the bank in a day as you drive down the street. Nothing makes it any simpler!

Should I Choose Truck Factoring for my Trucking Company?

Transportation is the area of expertise for freight factoring companies. They are familiar with the daily struggles and workings of the trucking industry. Business owners can concentrate on trucking instead of bookkeeping because of the speed, ease of use, and manageability of their services.

Factoring is an affordable method to improve the quality of life significantly. Most owner-operators of trucking companies employ factoring as a profitable business practice. You don’t need a factoring firm’s assistance to operate your trucking company effectively. However, you’ll need to budget for the protracted periods that your clients will take to pay you, which can severely impair the cash flows of most newly established trucking businesses.

Because truck factoring offers the steady cash flow required to move additional cargo and expand your business, many businesses prefer this method. Truck factoring may be helpful if your business is expanding faster than you can handle.

How to Choose a Freight Factoring Company?

1. Quick Cash

The best freight factoring companies can provide you with the money in hours. It’s time to look for a new factoring business that can expedite the procedure if you are currently factoring loads but are not receiving the payments within 24 hours.

2. Easy Approval

A truck factoring company should be easy and quick to work with. If your consumers are creditworthy, you should have no trouble getting approved by the finest freight factors, even if traditional lenders have turned you down. A lot of transportation factors don’t charge for applications. Therefore, be aware that many factoring firms do not need an initial charge if that is something you are unwilling to spend.

3. Personalized Approach

You transact business with individuals, not with an organization. You will be assigned a personal account manager from a reputable truck factoring firm to assist in maintaining account management on your behalf. Any queries you may have should be able to be answered by the account manager. You are paying for the service, after all.

4. Factoring in both recourse and non-recourse

Two freight factoring options should be available to you: non-recourse, where the factor bears the responsibility for unpaid bills, or recourse, where you are responsible for unpaid invoices. The factoring firm should review the benefits and drawbacks of both programs with you to determine which is best for your company. Remember that non-recourse trucking factoring will come with a little price increase.

5. Added Services

The best truck factoring should provide additional services for owner-operators and small fleets. Other freight factoring services that might be offered are:

- Programs for fuel cards

- Free credit reports

- Free load board access and 24/7 internet account access

- Expert services for collecting

- Support for new trucking firms with insurance

6. Funds for Copies

For truck drivers, immediate funding is crucial. Finding a truck factoring company that provides funds for copies, faxes, and scans. Not only is it difficult to submit creative work for financing, but it is also costly.

7. Absence of Minimum Volume Needs

It would be best if you could select which freight invoices to factor in and when to do so. You shouldn’t have to consider every client if you haul for specific brokers or shippers that pay on time. It is crucial to have flexibility when selecting a truck factoring firm. Track out a freight factor that will finance you according to your conditions.

8. Advances in Fuel

Is Payment up front required for fuel? If so, pick a transportation factoring provider that gives drivers fuel advances. Upon picking up a cargo, several factors give a cash advance for gasoline up to 50%. Fuel advances guarantee you’ll always have enough money to maintain a full tank and take on loads that pay more.

9. Flexible Contract Conditions

Read the conditions of the factoring agreement before signing. Look for a factor that provides a month-to-month arrangement to avoid being obligated to a year-long commitment. This kind of flexibility is provided by many of these truck factoring businesses.

10. High Advance Rates

You want to make sure you’re receiving as much cash as possible since invoice financing is a way to relieve cash flow constraints. Many factoring providers pay you back the remaining amount once your client pays the invoice, less their charge. They advance 80 to 85% of your invoice. Others can pay you 100% of your invoice in advance and offer more affordable prices.

11. Transparency

Before accepting the funds, you ought to be able to view your factoring charge and your entire factoring expenditure. This is because invoice factoring businesses can impose additional costs, such as application and service fees, on top of the discount rate (the portion of your invoice they retain) they provide. Make sure to inquire about these when assessing factoring firms.

12. Customer Support

An account manager should be able to assist you throughout and beyond your initial investment while getting to know you and your company.

Truck Factoring Application Process

Applying for credit and invoice factoring and giving over other personal or corporate information is unpleasant, and it often takes a few minutes with many freight factoring providers. While the timeline for getting the advance can vary, it takes around a day. However, it could take as little as an hour at most, depending on the factoring business you use. Ensure you fill out an application carefully to ensure it is not a binding contract, since some allow the factoring provider to collect your receivables immediately.

Gathering and exchanging business data, such as income and legal name, is the initial stage in the factoring application process.

You will then supply specifics on your bills from there. The terms and durations of Payment are the most crucial. Don’t withhold anything. It is simpler for a factoring company to decide if you are a suitable fit if you provide detailed information. Recent bank statements will also be requested by factoring companies.

You may fill out an official application with assurance now that you have all the information. After reviewing it and requesting more information, the factoring business will either approve or deny it. Signing up with the factoring company is the last step in the application procedure.

What to Check in Contract Terms?

First, the factor will likely send the company a proposal letter (which is not a contract) that includes some, but not all, of the provisions that might be included in the factoring agreement. Typically, a deposit and your signature are needed on this proposal letter. Next, depending on whether your business is a corporation or limited liability company, the factor will send you the proposed factoring documents, which include the factoring agreement, personal guarantees, a manager’s or secretary’s certificate, a proposed notice to your customers informing them that your company’s accounts receivable have been assigned to the factor, and various other related documents and agreements.

The factoring agreement may appear initially intimidating because it is often ten pages or longer. The ten clauses listed below are in all factoring agreements and are important for you to check and understand.

1. Upfront Fee

A business must usually pay an upfront charge to the factor when drafting a factoring agreement, due as soon as the firm receives funding. Although the money from the factoring agreement should cover the charge, factors usually want a modest amount up front.

2. Invoice Amount

Since the invoice amount directly affects cash flow, reviewing it when factoring agreements is important. Precise billing guarantees openness and aids in figuring out the financing’s worth. Evaluating invoice amounts also contributes to risk reduction, avoiding inconsistencies, and preserving a sound financial rapport between the parties.

Ensure accuracy by taking into account the following:

- Verify Line Items: Check the invoice for correctness and compliance with the specified terms by carefully reviewing each line item.

- Cross-check Quantities: Verify that the stated and delivered quantities of the items or services match.

- Verify the Price: Verify the prices again to prevent inconsistencies affecting how payments are calculated.

- Check money and Units: Confirm that the measurement units and amount correspond to the previously agreed-upon terms.

3. Factoring Fee

Because it guarantees long-term operations, the factoring fee is essential to factoring agreements. This charge covers the price of services rendered, risk mitigation, liquidity preservation, and preserving the company’s financial stability to enable it to keep providing clients with specialized solutions. It represents the benefit of allowing quick cash flow against receivables, which frees companies to concentrate on expansion while outsourcing credit and collection tasks.

To assess the cost of factoring in:

- Calculation of Percentage: Understand exactly what portion of the invoice amount the factor keeps as a charge.

- Extra Fees: List any additional costs that go above and beyond the standard factoring fee.

- Comparison with Market Rates: Determine how much the factoring charge is worth considering current market prices for comparable services.

- Charge Structure Terms: Comprehend the particular terms and circumstances that control how the factoring charge is computed and applied.

4. Advance Rate

In factoring agreements, the advance rate denotes the portion of the invoice amount that is paid to the customer in advance. It’s crucial since it establishes the instant cash flow pushed into the client’s company. Establishing the ideal advance rate requires striking a balance between customer creditworthiness, industry norms, and risk assessment to create a win-win situation that promotes development and stability in the financial system.

When determining the advance rate, take into account the following:

- Percentage Offered: Find out how much of the invoice total the component advances in advance.

- Industry Standards: To ensure the advance rate is competitive, compare it to industry benchmarks.

- Variable Rates: Recognize if the advance rate is set or fluctuates according to variables such as client credit or the age of the invoice.

- Effect on Cash Flow: Examine how the advance rate fits into your company’s financial goals and cash flow requirements.

5. Recourse or Non-Recourse

As for factoring companies, deciding between recourse and non-recourse factoring is a major determination of risk and liability factors. Recourse factoring may lessen the risks of the accounts receivable company, but it also makes the client accountable for being billed at a reduced fee. Since the factoring company is taking on more risk, non-recourse factoring is usually more expensive to the client, who must accept the risks from unpayable invoices. It is essential to thoroughly evaluate the risks of the accounts receivable and how creditworthy the customer is before choosing the recourse choice that’s most suitable.

- Factors to Consider: Risk management: Determine the company’s risk tolerance and, if you can absorb future bad debt, weigh your options on what to do about them. For customers with higher-risk levels of non-recourse, you may prefer to deal with them.

- Cost analysis: Recognise the effects of unlimited responsibility fees on finance and balance them against possible non-recourse losses.

- Legal implications: Consult with attorneys to fully understand the obligations and legal consequences of recourse versus non-recourse agreements.

6. Customers’ Creditworthiness

Evaluating a customer’s credit is critical in factoring since that determines the business’s risk. By comprehensively evaluating the chances of default or non-repayment, a far-reaching assessment will allow them to guarantee that assured payments will come. But to Protect the factoring company’s cash flow and overall financial health, take a close look at payment history, financial stability, and market image.

To ensure a comprehensive review, check

- Credit Reports: Regularly check customers’ credit ratings to determine their financial fitness.

- Payment History: Examine previous payment histories to spot any trends of defaults or late payments.

- Business Reputation: To evaluate a customer’s dependability, consider their standing in the business.

- Credit Limits: To reduce risk, determine and keep an eye on each customer’s credit limit depending on their creditworthiness.

Open communication is essential to immediately address any complaints or difficulties clients may have.

7. Termination Fee

A termination fee, often equal to a portion of the factor’s credit line, is typically given to the factor if a business stops the factoring arrangement.

It’s critical to understand what you commit to when you sign the contract because the percentage fluctuates depending on the element and the conditions of the agreement.

8. Client Limit

Factoring agreements provide the small firm with an overall credit line paid by the factor, but the factor will not want to burden much of that money with bills from a single client. When creating the agreement, it’s critical to ascertain the maximum amount of the credit line that can originate from a single customer’s invoice.

9. Modifications to Invoices

A business that sells an overdue invoice to a factory must notify the customer on their bills that the invoices have been sold and that they must pay the factory. Payments that are mistakenly made to the business rather than the factoring company have to be given back to the factor. Additionally, to guarantee that the associated bills and goods are delivered to clients, businesses must maintain the factor current on schedules for any applicable accounts.

10. Unauthorised Accounts and Conflicts

An invoice sold by a business requires the factor’s approval of the associated client. This might imply that the client must be considered credit-worthy and free of outstanding debt. Contracts provide factors that give the authority to designate invoice accounts as non-approved accounts. Most factoring agreements allow disagreements between the small business, the factor, and the client to be resolved before the account is no longer approved.

Pros and Cons of Truck Factoring

Pros of Truck Factoring

1. Quick Cash Access

After an invoice is approved, cash is accessible, as the accompanying graphic illustrates, within 24 hours. You can immediately finish your essential expenditures because there are no paper checks to cash. Cash on hand allows you to take advantage of quick-pay discounts and pay invoices far before their due dates, saving you money.

2. Maintains a Tidy Balance Sheet

Factoring freight is not a loan. Buying your open bills from a factor removes a potential source of creditworthiness risk by turning your accounts receivable into a liquid asset.

3. Quick Approval

Most financing decisions are made within three to five business days.

4. Flexible Finance

Factor in as few or as many of your bills as necessary to maintain efficient operations without committing to long-term contracts.

5. Funding Irrespective of Business Size

A freight factor may assist you, regardless of how many trucks you operate or how many you own and operate alone.

6. Considering a Customer’s Creditworthiness When Factoring Choices

In contrast to banks, factors rely on their approval instead of yours on the creditworthiness of your consumers. If your bills aren’t pledged anywhere else, factoring may be possible even if your credit isn’t the best.

7. Back-end Assistance

The choice to delegate collection and other back-office tasks to your freight factor frees you up to concentrate on delivering top-notch service.

8. Take the Copy Factor Out

To expedite the factoring process and avoid mailing original freight invoices, freight factor businesses enable you to send copies of your bills by fax or email.

Cons of Truck Factoring

1. Higher Rates

The interest rate associated with a traditional line of credit may be lower than freight factoring costs. A conventional lender, however, will not provide the extra services that freight factoring provides.

2. Bad Clients

Many freight factors demand that you buy back invoices sent after their window of opportunity, typically ninety days. For your security, all our factors run credit checks on your clients before authorizing them for funding. We also collaborate with freight factors that provide no-recourse finance if a consumer defaults.

3. Company’s Standing

When you factor freight invoices with the incorrect provider, you risk being taken advantage of and waiting months for advances. Factor Finders collaborates with freight factoring firms that are well-known in the field and have the know-how to give you the superior service you need.

Bank Loan VS Truck Factoring

How to raise money to start a business is the most crucial issue of all. Many of the conventional funding sources disappear during hard economic times. Banks frequently alter their lending criteria, making getting approved for credit more difficult. Contrarily, factoring firms believe that since they expand during most economic cycles, your company should too. You may determine whether sales are flourishing and the economy is booming, or thriving and the economy is declining. Thus, how can you determine if bank loans or truck factoring are better for your company?

1. Time of Processing an Application

Anyone who has filed for a bank loan is aware that the application’s acceptance and processing might take weeks. On the other hand, factoring frequently processes an approval on the same day that a completed application is submitted.

2. Financial Agreements

Many banks need certain business covenants before granting a loan or line of credit. These might include mandating that a company maintain a specific debt-to-asset ratio or retaining several important personnel. A bank can demand full Payment for any outstanding loan amounts if certain covenants are breached. This offers a bank considerable control over how your company is run. Covenants are typically absent from factoring agreements since factoring is not debt.

3. Procedures for Approval

Business credit and collateral are major factors in bank loan approvals and rates. Since your debtor’s invoices are what is being purchased, invoice factoring is more concerned with the quality of their credit. This makes money available to companies that would not otherwise be able to obtain it from traditional lenders, even those without collateral or credit history.

4. Flexibility in Funding

Once received, bank loans and credit lines, including truck factoring, are hard to modify. A procedure of audit and renegotiation that might take weeks or months to be authorised is often triggered by any increase. Factoring invoices is far more adaptable and may expand with your accounts receivable. No further terms, no renegotiation.

5. Advanced Services

The money is all you get when you acquire a bank loan or a line of credit. Reputable factoring firms offer their customers essential back office, credit reporting, and collections services that go above and beyond just providing cash.

How Much Does Truck Factoring Companies Charge?

- When factoring freight invoices, several factors are taken into account. First and foremost, there is the service charge from the factoring firm. To illustrate where costs enter the picture, let’s dissect the entire freight invoice factoring procedure into its parts.

- Suppose your shipping firm completed work, and your customer received an invoice for exactly $10,000. Although your customer has up to ninety days to pay the invoice, you are eager to get your hands on the money as soon as possible.

- You go up to a freight factoring firm and propose to sell them the invoice for about 90% of its worth (this figure might go up or down, but 90% is usually the upper limit).

- That money (about $9,000) is yours to do with as you like, just as if the client had paid you directly.

- The factoring business will contact the consumer again to attempt to collect Payment for the invoice.

- The factoring company will send you the remaining invoice balance once the client pays the entire invoice value, less the fee (which is a percentage of the invoice value; for instance, if the fee were 3%, the company would take $300).

- Not every company or even every invoice has the same rate. For instance, a reputable firm with excellent credit may only pay a modest cost, while smaller invoices may require a greater percentage to cover the factoring company’s overhead.

- Then, an additional charge may be referred to as the discounted cost. Even though this is typically quite minor concerning the total amount in the calculation, it is nonetheless important to note. Each day the client fails to pay the invoice, there may be a minor cost of 0.008% of the advance payment (as usual, this amount might vary).

- Therefore, in our example, the factoring business would receive $21.60, or 0.24% of $9,000, if your customer delayed 30 days to pay. As you can see, it makes sense to be conservative with your advance payment amount because you will accrue fewer discounted fees if you take less at first.

- After all, you essentially paid the factoring company $321.60 in advance for the Payment, leaving your company with $9,678.40. Of course, if you could wait until the client paid you directly, you would have all $10,000, but there are instances when a firm wants its money immediately. In that instance, accepting a loss to obtain the money can be worthwhile.

Do You Have to Pay Additionally for Truck Factoring?

The answer to this issue will largely depend on the business you are working with, but in general, setting up freight factoring doesn’t come with any hidden or extra expenses because everything will be quite clear when you sign up for the arrangement.

Among the costs or guidelines factoring businesses may have are:

- Advance fees: Businesses occasionally take off 1% or so of the advance payment. In the case we outlined above, for instance, a corporation may deduct 1% off the 90% advance they granted you, leaving you with 89% (i.e., $8,900 of your $10,000 invoice, less $100 from the factoring company).

- Requirements for turnover and reserves: This is more of a basic necessity than a charge. Many factoring firms won’t work with enterprises with yearly turnover or cash reserves below a particular threshold.

- Costs associated with ACH/wire transfers: If you use particular payment methods, such as wire transfers or ACH direct deposits, some businesses may impose extra, lesser costs. This might expedite the money transfer procedure, making it worthwhile in an emergency.

- Aging fee: Some companies go over and above the discounted fee. The typical discount fee is calculated by counting the days it takes a client to pay the invoice, but over time, an aging fee may increase this amount.

It would be best to be careful about entering into a non-recourse or recourse factoring arrangement since they are covered in the following sections. Both of these have slightly different payment criteria.

These possible costs will change depending on the source, just like anything else. Avoid signing up with the first factoring firm you see, since they can charge you a lot of money that you wouldn’t have to otherwise.

The Fee of Truck Factoring for Non-Recourse and Recourse.

- Recourse factoring is the most often used method to put these things briefly. If your client fails to make a Payment, your business must purchase the invoice back. This can be a little problematic due to the nature of factoring. You probably want to factor in an invoice if you need fast money for something else. If the factoring firm requests a return of the invoice, you may find yourself in a difficult financial situation.

- Conversely, non-recourse factoring involves a significantly higher level of risk assumed by the factoring business. You would not be obligated to purchase back the invoice if they requested you to. Naturally, this increased risk would result in a considerably larger cost towards the end of the process, and many factoring organisations won’t even give you this choice unless you have excellent credit and a solid history of relationships.

- Recourse freight factoring wouldn’t cost more in an ideal scenario where clients pay their invoices. The worst-case situation, though, can require you to purchase back the invoice, which isn’t ideal for your financial situation, especially if you’ve already used the money you received. The only expenses you’ll have to worry about, though, if this doesn’t work out, will be the ones you agreed to before the contract was made.

- We cannot provide a precise estimate for the overall cost of invoice factoring because of the many expenses an invoice may incur and the range of percentages a factoring business may charge as a fee. On the other hand, factoring organisations usually charge between 0.5% and 5% of the invoice value. Smaller bills often result in a greater %; the bigger the invoice’s value, the lower the percentage charge.

Do I Need a Factoring Company To Be Successful As An Owner-Operator?

You may increase your cash flow by using truck factoring to finance your invoices. Owner-operators who cannot wait 30 to 60 days to pay their shippers and brokers might benefit from this approach. You may utilise the quick money you receive from freight bill factoring to cover costs like gas and maintenance. newly, it gives you money that you can utilise to expand your business and take on new projects.

Comparing freight factoring to other options, there are various benefits. In addition to being easier to get than traditional loans, the solution is fast to implement and has an escalating credit limit as your company expands. The most crucial requirements for eligibility are:

- The owner-operator is required to act independently.

- Your shippers ought to own strong business credit.

- It is not permitted to pledge your invoices as collateral.

- Either you need a strategy, or your taxes need to be current.

This alternate owner-operator financing option assists truck drivers who cannot bear the prospect of waiting up to sixty days for Payment.

Final Words

Every factoring company has procedures to reduce risk and/or increase revenue. How such regulations impact your capacity to generate money determines whether they are a good or a bad firm. For example, you could receive a lower rate from some firms than others, which can seem too good to be true. Be cautious since they could add extra costs, such as ageing fees, per-invoice fees, swipe fees, transaction fees, and so on, to cover the difference. Some businesses might be able to charge less because they cut corners in customer service or collections, while others might not be able to pay you fast enough.

When it comes to factoring, you often get what you pay for; therefore, always enquire about the benefits of paying a higher rate. Certain firms also provide other perks, including fuel advances, aid for insurance downpayment, emergency roadside help, tire savings, dispatching services, small business loans, and truck finance. We hope that some of the confusion surrounding truck or freight factoring has been dispelled. Before contracting with one, carefully balance the benefits and drawbacks.